Two things the CEO is directly accountable for: Developing a winning strategy and making bank. Yet only one of these is truly in their direct control, and that is the setting of strategic intent.

Developing the strategy is directly in the CEO’s control.

Making bank is an outcome of a process, it is not a process in and of itself.

(EBITDA can be influenced but not entirely controlled)

Everything in-between strategy and bank is a process.

These processes are delegated to other people in the company, as they should be. Unfortunately, too often, we see CEOs abdicating instead of delegating. In other words, the CEO ‘trusts’ the teams to deliver the strategic intent, which will result in making bank. We see this behaviour repeating as we follow the process down the hierarchy, where neither COOs nor GMs nor HODs get sufficiently involved in leading their teams and holding them accountable.

Between abdication and micromanaging is delegation. Effective delegation means giving someone responsibility for something, but staying actively informed and remaining ultimately accountable. Abdication means giving somebody responsibility, not staying informed, and/or relinquishing accountability.

The degree by which one can delegate should be based on trust; this trust results from the delegate’s character and capability.

Disagree with us if you will, but we will argue that the CEO must care enough and ensure the following points are managed and controlled:

- Strategic initiatives are not well enough aligned with strategic intent: The CEO should be closely involved in laying out the company’s strategic intent, strategic targets and the resulting strategic initiatives as they are how strategy is executed; commonly, the CEO delegates (or worse, abdicates) the development of the strategic initiatives

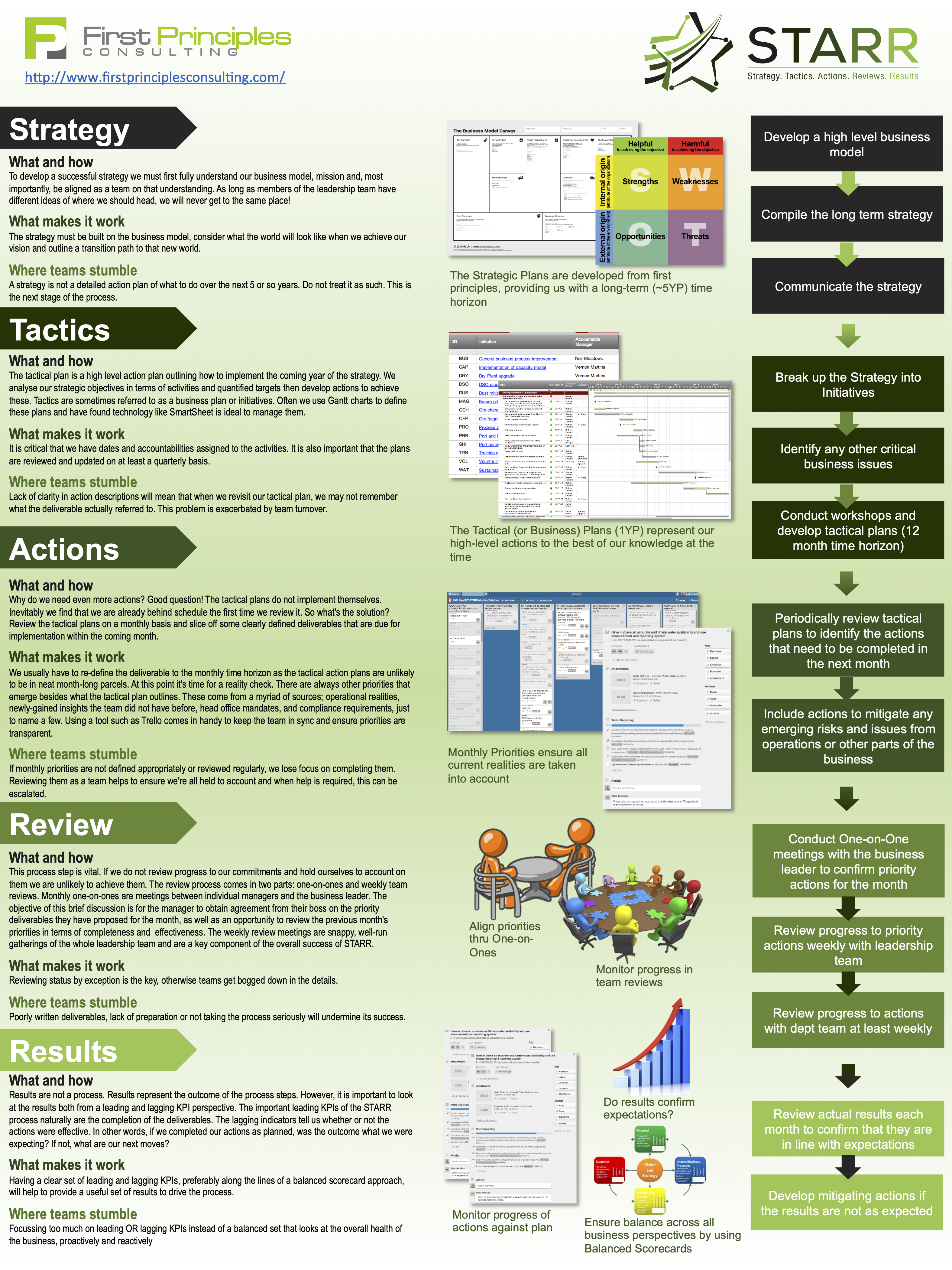

- The strategy implementation system is ineffective: Most mining companies do not have a system to ensure the strategic targets are attained and the strategic initiatives are implemented

- The CEO is flying blind: Business Intelligence is not providing the required insights. The CEO has insufficient visibility and transparency of the strategy execution (targets and initiatives). The Operations measure the wrong KPIs (mostly lagging ones), so there is insufficient insight and warning when ops are about to miss their targets and miss guidance

- Shareholders are in control: As the mine sites miss quarterly guidance, shares drop as shareholders demand their dividends. The pressure is on to “just make money”. This leads to high-grading, which in turn leads to mining schedule deviation, which derails the strategic plan for the rest of the financial year

- People are arse-covering and not telling their leaders the full story: Nobody likes to convey bad news. The mine sites are not in control and so they cannot deliver on their commitments. This can be hidden for a while but a falling commodity price will show them up. Because too many mining CEOs don’t have a fit-for-purpose Business Intelligence in place and don’t track the right KPIs, people can safely ‘hide’ the truth long enough for it to be too late to take corrective actions. Plus, for employees to accept accountability they need to feel sufficiently psychologically safe, so they are more likely to report accurately. Trust plays a big role in this, amongst other factors.

Conclusion

- In 2016, it was estimated that 67% of well-formulated strategies failed due to poor execution (HBR 2017).

- The CEO must ensure they fully own the strategy and that the strategic initiatives are well defined and owned by the respective business units.

- Strategy execution can only succeed if there is an effective system in place.

- The CEO needs insight into the status of strategy execution, including leading metrics and KPIs to provide enough heads-up to take timely corrective action.

- The mine sites need to become capable of delivering on their commitments so that the company doesn’t inadvertently end up being run by its shareholders and become a hostile takeover target.

- The organisation must have an effective Business Intelligence framework, providing actionable, accurate insight in a timely manner. And finally, there needs to be sufficient trust and Psychological Safety to allow employees to report good news as well as bad, while still taking responsibility for their actions and can be held accountable.